This article was scraped from Rochester Subway. This is a blog about Rochester history and urbanism has not been published since 2017. The current owners are now publishing link spam which made me want to preserve this history.. The original article was published July 14, 2013 and can be found here.

![19-23 Berlin Street [IMAGE: Google Maps]](https://senseofplace.dev/content/images/photos/19-23-berlin-street-rochester.jpg)

The following is a guest post submitted by Matthew Denker .

Submit your story today .

Welcome back dear readers. Today we're going to try something a little different at Filling In. Let's actually walk through a lightweight proposal in response to the city's RFP

for 19 and 21-23 Berlin St (due by 4pm this Friday, 7/19). Just as a disclaimer; I do not intend to submit this proposal. Additionally, you are welcome to take it and submit it, but I am not to be held liable for any damages should you do so.

![19-23 Berlin Street [IMAGE: Google Maps]](https://senseofplace.dev/content/images/photos/19-23-berlin-street-rochester-aerial.jpg)

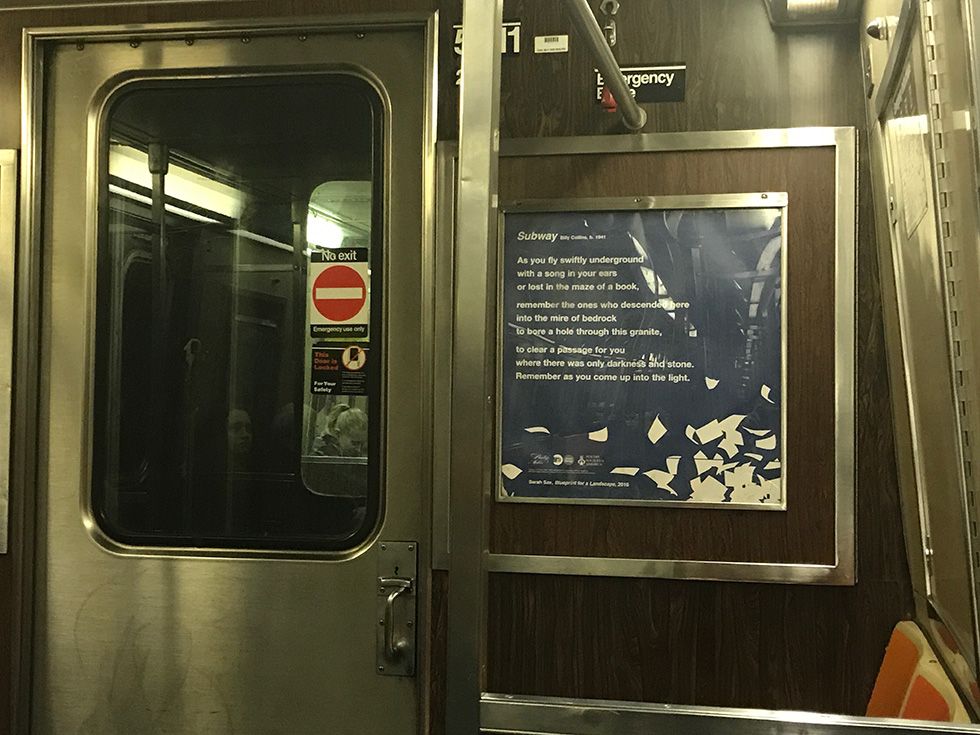

Ok, so, let's kick this off right. First, show of hands who could find Berlin St. on a map? Anyone? Oh well, as always, Google

has us covered. Above is a close up of the exact site.

For reference, it's 70ft along Berlin St. and 100ft deep.

Before we talk design, let's spend a moment thinking about the financials of the site. The city would like a grand total of $1,140 for it (yes, you're reading that correctly). What a steal. Unfortunately, the zoning is an unfavorable R-1, but let's imagine we could work with the city to get it up-zoned to R-2. This doesn't gain us any FAR (.5, if you were curious), but it does let us build 4 units here, instead of 2 or 3. We also have, any bonuses not withstanding, about 3500 square feet to work with. For the sake of this proposal, let's commit to 4 apartments between 700 and 850 square feet. Let's also make them 2 bedroom units (we'll circle back to this later). Based on prevailing local rents, we should be able to make anywhere from 500-750 a month on these apartments. These will be brand new, and I am, admittedly, a firm believer in the city's section 8 program, so that might also be the route to go to get paying tenants. For the sake of this proposal, let's fix the income on this housing somewhere in the middle at $650 a month. This sets our income each year at $31,500. Time to retire early!

Oh yeah, we're probably going to have expenses, huh? The basic list of expenses for a property like this is:

- Property taxes

- Management

- Maintenance

- Insurance

- Refuse

- Utilities

- Vacancy

So what do each of these items look like? Well, the house next door (29 Berlin St.) paid $1,711 in taxes last year. Let us assume our taxes are four times that (so $6,844)*. Management is 10% of gross rents ($3,150). Maintenance on a brand new building is acceptable to peg at 5% of gross rents ($1,575). Insurance is about $750 a unit ($3,000). Refuse will be about $1,500. For utilities, we will have each of the units metered separately, but water is almost always included with an apartment. That comes to about $250 a year per unit ($1,000). Finally, it is good practice to include a 5% vacancy allowance as part of your budget ($1,575). Phew! So what did that $31,500 cost us? $18,644. Ok, not bad. So we walk away with $12,856. That's not bad at all. Let's do this!

Hey, wait a second. You don't have the cash to fund this venture on your own? Well I don't have it, so I thought you had it. Crap. Ok, so we're not out to get rich being slumlords, right? So let's see what our budget is to break even. We can basically afford $1,050 a month in financing costs and still break even. At a 4.5% interest rate, we can borrow $205,000. The bank is going to want 20% too, so we need to come up with $51,250 (in addition to the $1,140 we needed for Rochester). Even so, it gives us a budget of $80,000 a unit. This is surprisingly reasonable, and I am positive we can break even. Let's think about doing even better, though.

To get specific about this site, I propose that we pour a slab, and drop a North American Housing Loudon Prefab multi-family home on it. Here it is (above) in an idyllic suburban setting. And this is what it looks like on the inside...

Now before anyone gets all nit-picky, it has blank sidewalls. This is not ideal for this site, and I believe we should spend a little bit of money to customize it with a porch that opens to the bedroom on the first, and possibly the second floor, as well as windows facing Berlin St. Either way, this will do. It will likely cost about $220,000 all in for this unit. Our plan for the site might look a little like this...

This gives us 2 parking spaces per unit, a porch for one of the 3 units, and a playground area for the kids. We could also consider a porch for the rear first-floor unit. Then, a little bit of landscaping tops it all off, and we're golden. The front door/lobby faces the parking lot. All 3 sides would receive picket fence.

Because we've gone prefab, the paperwork and the construction phases can basically happen simultaneously. That would give us a timeline of about 15 months. Move-ins would be expected next fall. Financing can happen one of two ways. A convertible construction loan might be the way to go, or NAH may have nice financing options for their units as well.

So to wrap this up, let's do a quick recap of everything we've covered. First, we are going to buy a property in cash from the city of Rochester for $1,140. Then we're going to build four apartments on it for $220,000. We'll need $44,000 of that in cash too, so we're out a total of $45,140. For our labors (investment), we'll earn $31,500 a year. From this, we will pay $18,644 in operational costs. We will also pay "the bank" $10,704 a year. When all is said and done, we will put $2,152 in our pockets. While there are theoretically taxes on this income, there will assuredly be enough depreciation from the property that we won't pay them. This makes our ultimate ROI right around 5%. Not bad for a hard day's (paper)work.

* It is quite possible we could work with Rochester to get some kind of tax break on this. Many investors would actually balk at the ROI here, as real estate is really risky. This is why the city offers tax breaks for development in the first place. Even a 50% break in taxes takes our ROI to 11%. That's notably juicier.

Addendum:

The RFP:

http://www.cityofrochester.gov/realestate

The building:

http://www.northamericanhousing.com/OurHomes/ModelDetails.aspx?mid=7607

* * *

About Matthew Denker:

Matthew Denker is a Project Director by day and a fantasy real estate tycoon by night. He has a deep interest in Rochester, NY, as well as the subjects of new urbanism, walkability, mass transit, and land use. Going forward he hopes to combine all of those things to make Rochester a city competitive not only with other small, successful cities, such as Portland and Minneapolis, but even better by leveraging its easy access to the world-class cities of Toronto and New York.